All Payment Option at One Place!

The future of money is digital currency.

The future of money is digital currency.

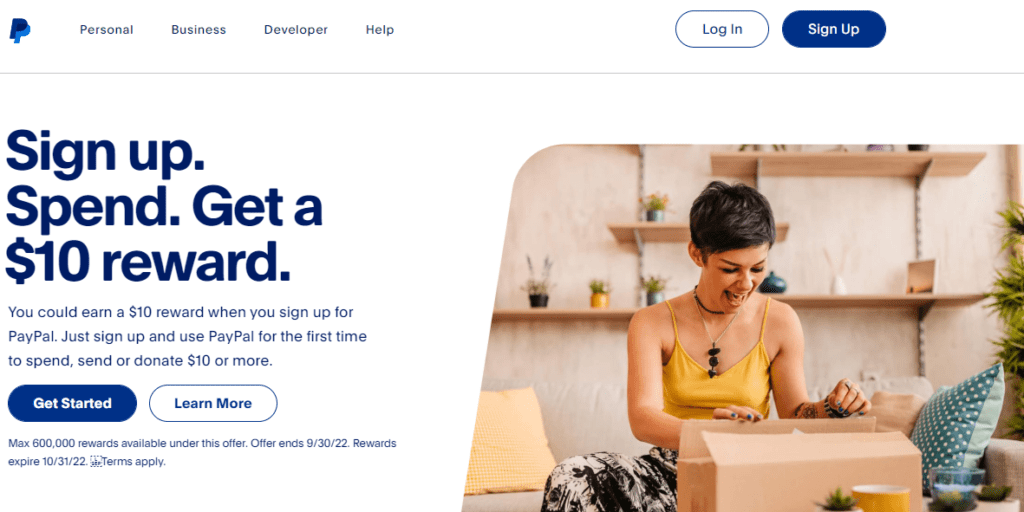

In today’s digital age, the way we handle finances has undergone a remarkable transformation, thanks to innovative platforms like PayPal. As our lives become increasingly intertwined with the virtual world, secure and convenient online payment solutions have become a necessity. And at the forefront of this financial revolution stands PayPal.

PayPal has become a household name, synonymous with effortless online transactions. Whether you’re an avid online shopper, a seasoned freelancer, or a business owner navigating the e-commerce landscape, PayPal offers a versatile and user-friendly platform to streamline your financial interactions.

But before we delve into the myriad features and functionalities of PayPal, let’s start at the beginning – the PayPal login. This humble step marks your entry into a world of secure and efficient online transactions. Whether you’re a newcomer or a seasoned user, understanding the nuances of logging in is the foundation upon which your digital financial journey is built.

In this comprehensive guide, we’ll walk you through the ins and outs of PayPal, from the basics of setting up your account to mastering its advanced features. So, fasten your digital seatbelt, and let’s embark on a journey to unlock the power of PayPal.

In the rapidly evolving digital landscape, PayPal reigns as a cornerstone of online financial transactions. With its extensive suite of features, PayPal caters to the diverse needs of users across the globe. From secure payments and buyer protection to seamless international transactions and a user-friendly mobile app, PayPal offers it all.

Its flexibility shines through its ability to link various payment sources, including credit cards and bank accounts, making transactions a breeze. PayPal’s widespread acceptance among online retailers and businesses further solidifies its status as a go-to payment solution.

Whether you’re a shopper seeking convenience, a freelancer receiving payments or a business owner looking for a versatile payment gateway, PayPal login account’s array of features empowers you to navigate the digital economy with confidence and ease. Join us as we delve deeper into the features that make PayPal a trusted name in the world of online payments.

In the vast realm of online financial services, PayPal stands as a multifaceted platform, offering a range of services that cater to the diverse needs of users. Let’s embark on a journey to explore the various services offered by PayPal, including the flexibility of multiple account associations, in concise pointers.

PayPal, a renowned international payment platform, is the preferred choice for many cross-border sellers due to its ability to link with third-party payment platforms. It operates across 200+ countries, supports multiple currencies, and offers swift transaction processing—crucial for cross-border e-commerce.

However, account association issues can sometimes hinder PayPal login user experience. Moving ahead, we explore efficient solutions to tackle the challenge of multiple PayPal account associations.

PayPal has become a crucial instrument in a digital environment that is continually changing. It enables people, companies, and NGOs alike thanks to the ease of PayPal login and the flexibility of its offerings.

We’ve identified the importance of having many PayPal accounts, highlighting their part in fostering financial independence and openness. Security is crucial, though, so we looked into ways to avoid unwelcome linkages.

PayPal is still a dependable ally as we travel the digital frontier. It continues to revolutionize online transactions with innovation and security at its core. Embrace PayPal’s limitless potential and the world of online finance, where ease and security come together to create a secure future.

The reason why PayPal is considered to be one of the most trusted platforms is because of the advanced data encryption technology that it uses while any transaction is being executed. On the other hand, it uses a seller protection protocol allowing sellers to have peace of mind when using PayPal.

The only disadvantage of using PayPal is that it charges a fee of 2.9% for executing online transactions. Additionally, if someone else gets access to your PayPal login credentials, you will have to face the consequences.

In case you are finding it difficult to access PayPal services or cannot sign into your account, then the PayPal website might be facing downtime issues. You can check the operational status of PayPal on the downdetector platform. Otherwise, try logging into PayPal from another device.

Well, this is a possibility only if someone else has access to your PayPal login credentials or this could happen when you sign in from a public device and forget to log out. So, be extra careful with your login activities.

When it comes to managing cryptocurrency, wallets are a...

In the fast-paced world of cryptocurrency, security is ...